Comprehensive Technical Analysis for Arweave (AR)

As of 02/12/2024 01:14:44

Executive Summary

Based on the latest technical indicators, the current recommendation for Arweave (AR) is: Hold Off.

This analysis synthesizes multiple technical indicators to provide a well-rounded perspective on the asset’s potential movements.

Technical Indicators Overview

1. Price Analysis

- Latest Close Price: $25.00

- Support Level: $12.4680392073,18.7596419116

- Resistance Level: $26.1854903467,26.1854903467

2. Relative Strength Index (RSI)

The RSI measures the speed and change of price movements. Values above 70 indicate overbought conditions, while values below 30 suggest oversold conditions.

- RSI (7-period): 72.63

- RSI (30-period): 59.28

3. Stochastic RSI

Stochastic RSI is a momentum oscillator that applies the Stochastic oscillator formula to RSI values, making it more sensitive to price changes.

- StochRSI %K (7-period): 83.64

- StochRSI %K (30-period): 96.54

4. Moving Averages (SMA)

Simple Moving Averages (SMA): Simple Moving Averages smooth out price data to help identify trends over specific periods.

- SMA (7-period): 22.98

- SMA (30-period): 19.12

- Trend Analysis: The short-term trend is bullish as the 7-period SMA is above the 30-period SMA.

5. Average True Range (ATR)

ATR measures market volatility by decomposing the entire range of an asset price for a given period.

- ATR (7-period): 2.07

- ATR (30-period): 1.89

6. Moving Average Convergence Divergence (MACD)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- MACD (7-period): MACD: 1.78, Signal: 1.19

- MACD (30-period): MACD: 1.78, Signal: 1.19

7. Average Directional Index (ADX)

ADX measures the strength of a trend. Values above 25 indicate a strong trend, while values below suggest a weak trend.

- ADX (7-period): ADX: 44.23, +DI: 34.78, -DI: 6.92

- ADX (30-period): ADX: 14.32, +DI: 25.44, -DI: 15.25

8. Rate of Change (ROC)

ROC is a momentum oscillator that measures the percentage change in price between the current price and the price a certain number of periods ago.

- ROC (7-period): 23.32%

- ROC (30-period): 73.61%

9. Risk-Reward Ratio

The risk-reward ratio assesses the potential reward of a trade against its potential risk.

- Risk-Reward Ratio (7-period): 0.09

- Risk-Reward Ratio (30-period): 0.09

10. Bullish Candlestick Patterns

Bullish candlestick patterns can indicate potential upward price movements.

- 7-period Patterns: No bullish patterns identified.

- 30-period Patterns: No bullish patterns identified.

11. Volume Analysis

Trading volume indicates the strength of a price move. High volume during price increases suggests strong buying interest.

- Yesterdays Volume: 239453173.46

Price Charts

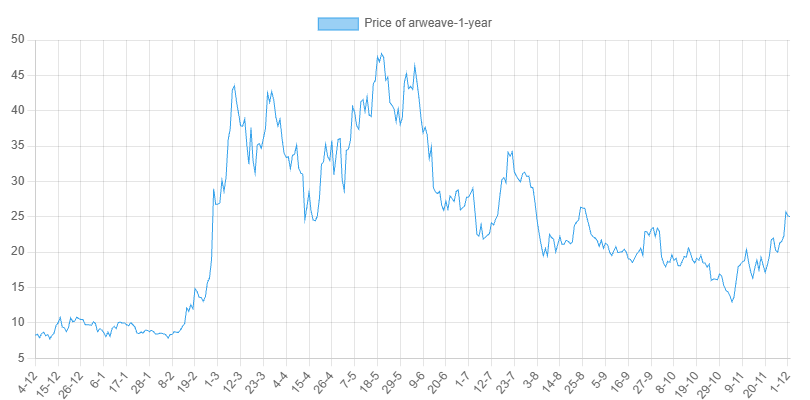

Price Over the Last Year

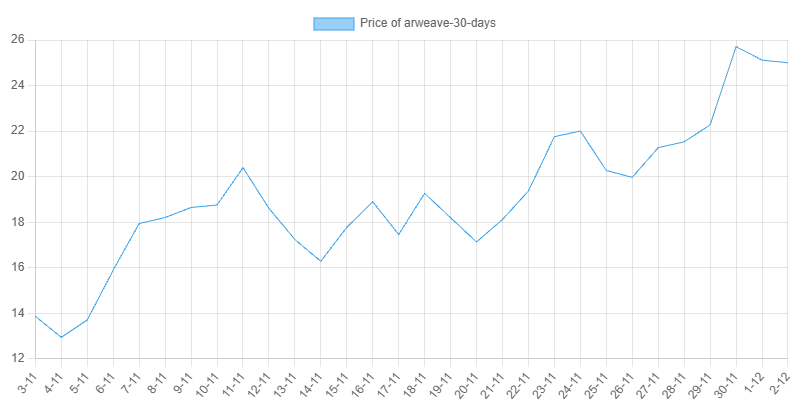

Price Over the Last Month

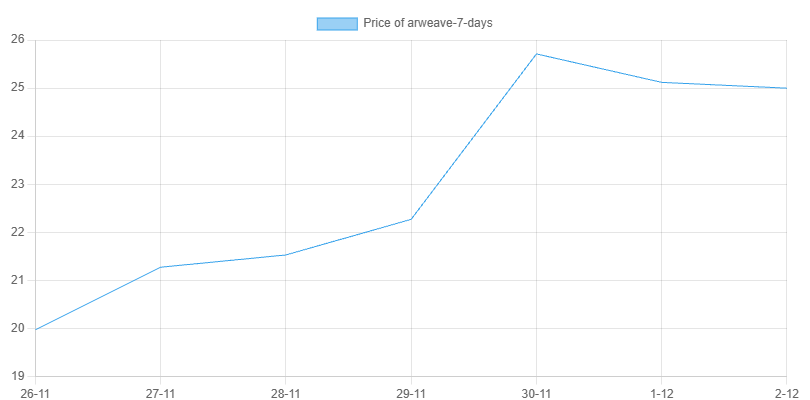

Price Over the Last 7 Days

Detailed Indicator Analysis

Relative Strength Index (RSI)

The RSI is currently at 72.63 (7-period) and 59.28 (30-period).

Overbought conditions.

Stochastic RSI

The Stochastic RSI %K is at 83.64 (7-period) and 96.54 (30-period).

Overbought.

Moving Averages (SMA)

The 7-period SMA is N/A, and the 30-period SMA is N/A.

Short-term trend is bearish.

Average True Range (ATR)

ATR values are 2.07 (7-period) and 1.89 (30-period), indicating the current market volatility.

High volatility.

Moving Average Convergence Divergence (MACD)

MACD readings are as follows:

- 7-period: MACD: 1.78, Signal: 1.19

- 30-period: MACD: 1.78, Signal: 1.19

Bullish momentum

Average Directional Index (ADX)

ADX values are [object Object] (7-period) and [object Object] (30-period).

A weak or no trend.

Rate of Change (ROC)

ROC values are 23.32% (7-period) and 73.61% (30-period).

Positive momentum.

Risk-Reward Ratio

The current risk-reward ratios are 0.09 (7-period) and 0.09 (30-period).

Unfavorable.

Bullish Candlestick Patterns

Detected bullish patterns in the last 7 periods: No bullish patterns identified.

Detected bullish patterns in the last 30 periods: No bullish patterns identified.

Volume Analysis

The yesterdays trading volume is 239453173.46.

High trading volume indicates strong interest.

Final Recommendation

Recommendation: Hold Off

This recommendation is based on a combination of multiple technical indicators:

- RSI and Stochastic RSI levels indicate potential overbought or oversold conditions.

- MACD trends suggest bullish or bearish momentum.

- ADX values confirm the strength of the current trend.

- ROC provides insight into the momentum direction.

- Risk-Reward Ratios assess the potential profitability versus risk.

- Bullish candlestick patterns highlight potential reversal points.

- Volume analysis indicates the strength of price movements.

It’s essential to consider these factors holistically rather than relying on a single indicator.

**Note:** Technical analysis is not foolproof and should be complemented with fundamental analysis and market sentiment evaluation. Always perform your due diligence before making trading decisions.